Paypal Limits When Having to Upload Business Docs

PayPal Business organisation Account: Everything You Need to Know

Whether you're on the chase for a style to turn your hobby into a legitimate business organization or you're a seasoned vendor looking to aggrandize and grow, figuring out how to get paid in a mode that's quick, painless, and affordable is 1 of the most of import operational bug y'all'll need to solve.

Processing online payments, in particular, is especially disquisitional. Over half of Americans now pay their bills online. And in early 2019, sales from online stores eclipsed those of general merchandise stores for the first fourth dimension.

The good news is that only as due east-commerce has revolutionized the way people buy and sell goods and services, it has as well forever contradistinct the way people bear business online, with new solutions making accepting and processing payments easier and more frictionless than ever.

PayPal is far and away ane of the pioneers in the space. Chances are, you've already used the online payment provider to make a purchase in the last few years.

PayPal Commerce Platform Forms

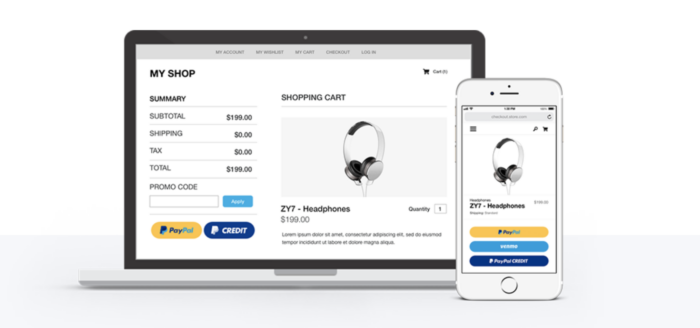

PayPal Commerce Platform offers an all-in-one payment and commerce solution for businesses looking to simplify onboarding, provide more payment options, and keep payment data secure. To offset collecting coin through your website with no additional transaction fees and no need for a PayPal merchant account, create a custom payment, order, or donation form with our drag-and-drop Form Builder!

What y'all might non know, however, is that the organization launched a merchant services wing in the early on 2000s that not just gives business owners of all sizes the power to get paid faster and easier, merely that also helps companies big and small abound and scale.

What is a PayPal business account?

PayPal is one of the most well-known online payment service providers (PSPs) in the world. A PayPal concern business relationship makes it fast and easy for businesses merely getting started, equally well equally those that are more than established, to take and procedure credit card payments, debit card payments, and more in over 25 currencies and from over 200 countries.

Like competitors Square and Stripe, PayPal works by taking a small percentage of transactions made using their platform.

It's also super simple for your customers to check out and make purchases via a PayPal business business relationship. They don't necessarily need to have a PayPal business relationship themselves (they tin can do their shopping every bit a guest), and they can cull to pay via whatever of the following methods, both online or in person:

- Credit cards

- Debit cards

- PayPal

- Venmo

- PayPal credit

The credit and debit cards PayPal concern accounts accept

| Credit cards accepted by PayPal business accounts | Debit cards accepted by PayPal business accounts |

| Visa | Visa |

| Mastercard | Mastercard |

| American Express | |

| Notice | |

| JCB | |

| Diner'southward Society | |

Private label cards, like department store cards, and procurement cards aren't accepted.

Debit cards that aren't Visa or Mastercard and crave a numeric password are also not accepted.

Thank you to PayPal's history — it was caused by eBay in its early days — information technology's also more often than not regarded as one of the almost robust PSP solutions for e-commerce businesses. It integrates with hundreds of commerce platforms, including both specialty online marketplaces similar eBay and Swappa as well as custom online stores similar WooCommerce and Magento.

And for those on-the-go or brick-and-mortar vendors that still primarily accept payments in person, a PayPal business business relationship offers PayPal Here, which provides business owners with a mobile app and an assortment of carte readers.

Beyond just solving the core operational problem of getting paid, however, a PayPal business organization business relationship also helps business organization owners manage and scale their companies.

The PSP has expanded the services they offer over the years to include everything from a launch kit for newbies and shipping help for those that need to evangelize products, to lending options for veterans looking to grow their career opportunities and even reporting for those that want to better understand where they're succeeding and where they have room to improve.

Types of PayPal business accounts

A PayPal business business relationship comprises two overarching payments processing options for business organization owners:

PayPal Payments Standard. This bones PayPal business account doesn't charge a monthly maintenance fee and allows account holders to accept all of PayPal's payment methods (except for payments fabricated via telephone, fax, or virtual last). Information technology too includes the standard PayPal business organization account benefits, similar cost-free phone back up and simplified PCI compliance functionality.

PayPal Payments Standard is ideal for concern owners just getting started too as those who are more than happy with a no-frills checkout option on their website or via their east-commerce platform provider. Customers are taken to PayPal'due south site to complete payment and returned to the concern's site later on.

PayPal Payments Pro. A step upward from its standard analogue, PayPal Payments Pro includes all of the perks that come with the bones business relationship also as the power to have payments via telephone, fax, or virtual final.

This business relationship also gives business owners complete control over their checkout pages, which makes it ideal for those who actually want to take their east-commerce site to the next level. Customers never get out the business's site when making a payment.

Unlike PayPal Payments Standard, this pick comes with a monthly maintenance fee of $30.

Pro-Tip

Connect your PayPal business account to Jotform to offer more payment methods on your online grade.

Boosted PayPal concern account merchant services

A PayPal business account also includes a suite of services beyond payment processing. Some of these are included in the accounts outlined above, like invoicing and eligibility for a PayPal debit carte du jour, but other features require an additional application process or development piece of work.

- PayPal Checkout. In a nutshell, PayPal Checkout adds Smart Payment Buttons to your e-commerce site that allow users to buy your goods and services with one click, bypassing a tedious guild process that involves long, complicated forms. PayPal then provides you with the client's contact information and shipping address, if appropriate.

- PayPal Business Loans and Working Capital letter. Cash menses is one of the primary problems a growing business faces. With PayPal Business Loans and Working Capital, the PSP makes it relatively uncomplicated for companies with a PayPal business business relationship to get the funds they need to keep expanding.

- PayPal Marketing Solutions. Like the free invoicing, shipping, and debit card options that come with PayPal Payments Standard and Pro accounts, PayPal Marketing Solutions is baked into the offering. This valuable suite of features includes insights into how oft your customers are shopping, how much they're spending, and how they're interacting with your checkout feel. To enable this service, all yous have to do is copy and paste a snippet of code onto your website.

According to PayPal, PayPal Checkout is responsible for 82 percentage more conversions (meaning people who really complete the checkout procedure). To add PayPal Checkout, you'll either need to utilize i of the many east-commerce platforms that accept already integrated with it or you'll need to work with a developer to implement it on your site.

Both options provide eligible applicants fast access to cash — sometimes as shortly equally the next business concern day upon approving — and both as well take a lower bulwark to entry than many formal lenders, similar banks, that require heaps of paperwork and credit checks.

The main divergence between the ii is that PayPal Business organisation Loans provide loans of between $5,000 and $500,000, and PayPal Working Capital doles out between $1,000 and $300,000.

To authorize for a PayPal Business organisation Loan, you lot must pass a credit bank check, and your business must be at to the lowest degree ix months old and brand at least $42,000 in revenue. You tin can fix repayment terms at a stock-still charge per unit as long equally they're between 13 and 52 weeks.

PayPal Working Majuscule doesn't require a credit check or minimum revenue; still, you must exist an existing PayPal customer who's had a PayPal business account for at least ninety days and candy $15,000+ with PayPal within the by year. This option gives you lot access to upwardly to 35 percent of your PayPal sales. You lot tin can repay the loan past deducting a percentage of your PayPal sales that you choose.

seven benefits of a PayPal business account that you should know almost

-

No monthly maintenance payments

-

Lightning fast setup

-

Low barriers to entry

-

Get paid online or in person, in the U.S. and from away

-

Easy e-commerce integration

-

Go cash back with the PayPal concern account debit carte du jour

-

Leverage discounts for nonprofits and charities

Far and away 1 of the best perks of a PayPal business account is that the standard account comes with absolutely zero monthly maintenance charges. That means that there's no cost to sign up and first accessing all of the merchant services on offer.

At that place are likewise no setup or cancellation fees. You'll only be charged when you really start doing business (see the chapter on PayPal business business relationship fees), which means you tin can spend your time — and your actress cash — on the other business concern services that matter.

It takes as little every bit 15 minutes to become upwards and running with a PayPal business organization account. Since the registration process is completely digital, you can go through the quick and easy online steps wherever and whenever yous want. There's no waiting in line at the bank, and you won't find yourself on the other end of a frustrating phone phone call that by and large consists of bad hold music.

Unlike erstwhile-schoolhouse merchant account providers that often come with complicated qualifying terms and heaps of paperwork, a PayPal business organisation account merely requires some basic contact data and general details virtually your visitor. Anyone can sign up — a credit bank check isn't necessary. You merely need to link a bank business relationship in order to receive funds from your transactions.

Another huge perk is that a PayPal business business relationship is flexible when it comes to accepting payments. Customers tin pay with major debit and credit cards as well as PayPal, Venmo, and PayPal Credit (they don't even need a PayPal account). What's more than, people can make purchases online, in person, or even via invoicing. Finally, PayPal makes information technology possible to do business organisation over borders and even across language barriers — it's bachelor in 25 currencies and across 200 countries.

A PayPal concern account syncs with hundreds of solution providers and shopping carts. Most major providers and fifty-fifty many of the smaller players have a simple option in their admin panel where y'all can select the PayPal integration and enter your login details and relevant credentials — it's that easy.

Ill of all the expressionless-end debit cards that don't give y'all any incentive to actually spend the hard-earned money y'all're making? Then y'all'll be happy to know nearly PayPal Business Debit Mastercard, which comes complimentary with an business relationship (you only need to request the menu) and gives you lot i percent cash dorsum on eligible purchases.

Y'all can apply the card to immediately admission all the funds in your PayPal account without having to transfer anything to your business organisation depository financial institution business relationship, whether you're withdrawing from an ATM or making an in-store purchase (the carte works anywhere that accepts Mastercard).

The PayPal business business relationship likewise offers special, cheaper transaction rates for registered 501(c)(3) organizations. The organization even has a fix-to-roll donate push that anyone doing fundraising tin rapidly and hands add to their website once they've created a PayPal business account.

Equally a bonus, PayPal has done the legwork to integrate with pop fundraising sites, like FundRazr, then that it'south easy to activate their services and start accepting the coin you demand.

Who needs a PayPal business organization account?

You may have heard stories nigh many casual sellers launching booming businesses from their personal PayPal accounts over the years. And then information technology wouldn't exist surprising if you're wondering what the deviation is between a PayPal personal account and a business account — and why a sole proprietor or small business owner should consider opening i or the other.

In a nutshell, PayPal's personal account is designed primarily for purchasing and sending coin. All that's required is for you to provide contact information and a verifiable bank account. On the flip side, while you can receive funds from other PayPal users, you lot won't exist able to have every bit many types of payment, nor will y'all be able to extend access to your account to employees or colleagues or have advantage of business concern-targeted services such every bit PayPal Checkout or PayPal Marketing Solutions.

In addition, opening a separate PayPal business account volition preclude you from mixing up personal purchases with business expenses and personal monetary gifts from concern revenues. If you've gambled on being able to track everything through your personal account and your side concern suddenly takes off, yous'll spend hours extricating personal transactions from business organization transactions at taxation time, and the stakes for making a mistake could be loftier.

Since phasing out its Personal Premier accounts, PayPal'south business organisation account has become the virtually sensible account selection for even the smallest businesses, including freelancers and modest artisans. Well-nigh anyone who plans to collect revenue or distribute money for business purposes volition benefit from opting for a business concern account rather than a personal account.

From increased access to a diverseness of payment options, to client back up, to analytics and tracking, the business organization account is designed to assistance your small business organisation grow into a mid-sized business concern. And for a $30 monthly fee, PayPal Payments Pro is prepare to help you lot grow further with scalable benefits and services.

Here are a few types of businesses that tin can benefit from a PayPal business account.

Pro-Tip

Connect Jotform to your PayPal business organization account to seamlessly collect payments through custom online forms. Sign up for gratuitous today.

Freelancers and entrepreneurs with a sole proprietorship

PayPal suggests using a business account if you operate a revenue-generating endeavor under a separate proper name — for example, if you've set an LLC. All the same, in that location are legitimate reasons why successful freelancers and sole proprietors might want to consider opening a business account even if they haven't yet registered a formal business and called a company structure.

PayPal business accounts allow you to integrate your payment systems with their payout system to create a seamless accounting system you can use to easily monitor sales and profits as well as expenses. Opening a split PayPal business account will make it easier to summate profits and expenses when information technology comes time to file taxes.

One of the most compelling reasons freelancers may want to consider using a PayPal business account is that it can expedite payments from clients, with transactions often taking only minutes. Fifty-fifty for artisans or vendors who practice business in person, frequenting arts and crafts fairs, farmers markets, and flea markets, a business account provides integrated swiping, online payment, and credit card processing systems, and even tracks receipts for you (you just demand to activate PayPal Here).

The risks for opening an business relationship are low since there are no startup, termination, or monthly fees. Equally far equally transaction charges are concerned, they are the same whether y'all receive payment through a personal business relationship or a business account.

Moonlighters and side hustlers

If you're trying to transform a passion into a turn a profit-making business organisation, using your free fourth dimension to raise income through a side hustle, or looking to get a concern off the ground while still working long hours in a more conventional staff position, you likely don't accept much spare fourth dimension to devote to bookkeeping.

So it'due south unlikely you lot have the time to untangle information from a personal PayPal account. Separating personal monetary gifts from customer transactions and personal purchases from business organization-related expenses at tax time is likely to exist confusing, frustrating, and a waste of time.

With no upfront or monthly fees, setting upward a separate PayPal business business relationship, or adding one if you already have a personal account with PayPal, is a sensible solution for hard-working, aspiring entrepreneurs who still have one foot in the wage-earning world.

The PayPal Payments Standard account volition track customer receipts for products or services purchased, also expenses paid to contractors yous hire or products yous purchase to get your new business upwardly and running.

By keeping your business organization and personal accounts separate, y'all spare yourself the confusion and tediousness of sifting through transactions to make up one's mind which are personal and which are related to your side concern.

Vendors on eBay and Etsy

Originally caused past eBay back in 2002 earlier information technology spun off to get information technology alone again in 2015, PayPal was once the go-to system for transactions on the popular online marketplace.

That said, if you're asking yourself, "Do I need a PayPal account to sell on eBay?" the reply is technically no. It's possible to opt into eBay's Managed Payments service, which allows you to receive funds direct into your bank account.

However, PayPal remains the simpler and faster of eBay'southward accepted payment options, which means that those who currently use PayPal don't demand to exercise anything to receive customer payments through their PayPal business accounts and can, equally was the case before, expect a super seamless feel that'southward incredibly safe and efficient.

And then while you lot don't necessarily need a PayPal business business relationship to sell on eBay, it tin simplify your operations.

Similarly, if you're a creative who's created a nice little cottage industry hawking your inventions and projects on Etsy, you'll be happy to hear that PayPal is an automatic option if you lot're using Etsy Payments. And even if you lot're not, you can easily configure your payment settings to accept PayPal payments.

Small-scale businesses (SMBs) and startups with an LLC

If you've set upwardly a limited liability visitor (LLC) for your pocket-sized businesses to protect your personal avails, opening a PayPal business account tin extend your client base and evangelize more marketing value.

Co-ordinate to information nerveless past comScore, customers complete 88 pct of initiated checkouts on PayPal. Consumers using other digital wallets failed to purchase items they'd saved to shopping carts 44.7 per centum of the time.

And PayPal's mobile payment options tin expand the viability of modest businesses, allowing them to keep up with a growing digital marketplace. (In 2019 virtually eighty percent of consumers reported using a mobile device to brand a purchase.)

If your company upgrades to PayPal Payments Pro, your customers tin remain on your website to consummate transactions on your own dedicated payment page with your branding. When your customers don't have to go out your site to make a payment, they're more probable to continue shopping.

Corporations

PayPal business organization accounts let access to upwardly to 200 employees. You tin can set a variety of access levels to protect your customers' privacy and your business interests. PayPal likewise allows you to gear up upwardly a separate email for customer service issues.

PayPal business accounts include setup support and business consulting, including customer analytics, with a range of benefits and enhancements at the Payments Pro level that are designed to scale to your business as it grows.

PayPal can accept payments in 25 forms of currency and from more than 200 countries. You can also use PayPal to ready subscriptions and other forms of interval payment, too every bit customized invoicing.

The standard corporeality y'all can transfer in a single transaction is $ten,000, but you tin can increase this limit by contacting PayPal and providing sure verification information. Though PayPal aims its services at small and mid-size companies, several large online retailers utilise PayPal as a payment choice for their customers, and for businesses that rely on a loftier volume of payments of less than $x each, PayPal offers a special micropayment fee structure.

If your business has the good fortune to generate large amounts of income through sales, then PayPal'due south per-transaction processing fees can add up quickly. In this case, yous may need to look for another online transaction solution that offers a apartment charge per unit or work with PayPal to create an individualized fee structure. The PSP has stated that they're committed to scaling their products to grow their customer base of operations.

PayPal isn't designed for businesses that rely on frequent large transfers of cash from vendors to other business partners.

PayPal business accounts for nonprofit organizations

PayPal has go an important part of the nonprofit landscape, with more than than i one thousand thousand users donating over $106 1000000 via PayPal on GivingTuesday 2019 solitary. Those donations, like all donations made in December 2019, were augmented by 10 percentage from the PayPal Giving Fund. The rest of the year, PayPal's Giving Fund kicks in 1 percent on every donation toward whatever verifiable 501(c)(iii) charities users designate.

PayPal's low costs, relatively fast transactions, reputation for reliability and security, and vast puddle of users can all be leveraged to fuel charitable fundraising. In many cases, donation dollars bear witness up in your organisation'south account within minutes. From there, y'all tin transfer money to your organization'due south bank account at no charge. More 600,000 nonprofits already receive funds through PayPal.

Fees for nonprofits

Registered charities with 501(c)(3) status pay a reduced per-transaction rate of 2.two percent plus 30 cents for U.South.-based donations, and 3.7 percent plus a fixed fee for international donations.

Donor tracking and access

Creating a PayPal business concern account and enrolling in their Giving Fund tin aid your organization tap into the payment platform's growing segment of donors, including the 8 million users who donated to charities in 2017.

What'due south more, monthly statements and searches let you to easily track and leverage donor information. There are also options that allow donors to sign up for recurring monthly donations.

According to a survey conducted in 2014, 28 percent of PayPal charitable donors said they wouldn't have made their donations if PayPal hadn't been among the payment options.

Secure donor transactions from anywhere

Using PayPal Here, you tin can accept payments onsite at fundraisers using a mobile device. With a standard account, your nonprofit organization can get, at no extra charge, upwards to five bones credit card-reading attachments (though more avant-garde card readers with additional security are recommended for nonprofits that expect higher volume donations) or 3 chip and swipe readers that tin can exist used with a smartphone or tablet.

The information donors provide at the point of sale tin exist automatically integrated into your donor contact listing. And you tin help keep this data secure by setting user permissions so that volunteers and employees can complete only specific tasks.

PayPal has also partnered with a variety of national and international applications and online resources aimed at the not-for-turn a profit sector, which means that enrolling in their solutions for nonprofits can extend your accomplish to donors throughout the globe.

Services and benefits

Like all PayPal business concern accounts, nonprofits can access free, vii-day-a-week customer support. Your arrangement will be eligible for a PayPal Business Debit Mastercard, which allows you to earn 1 percent cash back on expenses.

Even if you opt not to open up a PayPal concern account, y'all can enroll in the PayPal Giving Fund, giving potential donors the opportunity to allocate funds to your organization using eBay, Go Fund Me, Humble Packet, and other online applications when they purchase items using PayPal. Once you're enrolled, the PayPal Giving Fund volition manage tax receipts for your donors automatically.

Nonprofit partnerships

PayPal has partnered with some of the most recognized platforms in the nonprofit sector to expand the attain of nonprofits to online donors, including the digital transaction solution Paperless Transactions, the online fundraising platform FundRazr, fundraiser management software provider Swish, marketing and elective appointment arrangement BlackBaud, donor direction and fundraising software Network for Good, and eBay.

Each of these solutions allows you to set PayPal every bit your preferred transaction provider and integrates your business account into their platform for easy use by staff, volunteers, and donors.

PayPal business organisation business relationship requirements

Among the advantages of a PayPal business business relationship are the relatively few requirements and the absence of up-front end fees. There are no minimum capital or sales volume requirements either, making it an attainable next pace for sole proprietors or minor businesses looking to extend their range and increase their clients' payment options.

Getting started: What you'll need to open a PayPal business account

If yous don't take a split up banking concern account for your business organisation, yous should consider setting up 1 before you prepare a PayPal business account.

You can use your personal account, but it's best to have at to the lowest degree 2 bank accounts as you begin your entrepreneurial endeavors on PayPal — ane personal and one for your business. This will make information technology much easier to rail payments and business expenses, consummate your taxes, and gauge your business's rate of growth.

Once you have both your personal and business bank accounts in place, yous tin can sign up for a PayPal business account in a few unproblematic steps.

As with a PayPal personal account, you'll need to confirm your e-mail address, provide contact data, and provide account information for the bank account where y'all'd similar the money to exist deposited; a designated business organization banking account is recommended but not required.

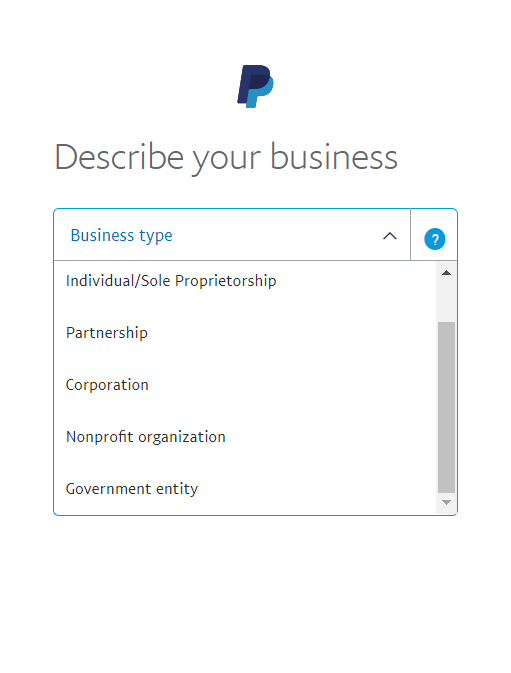

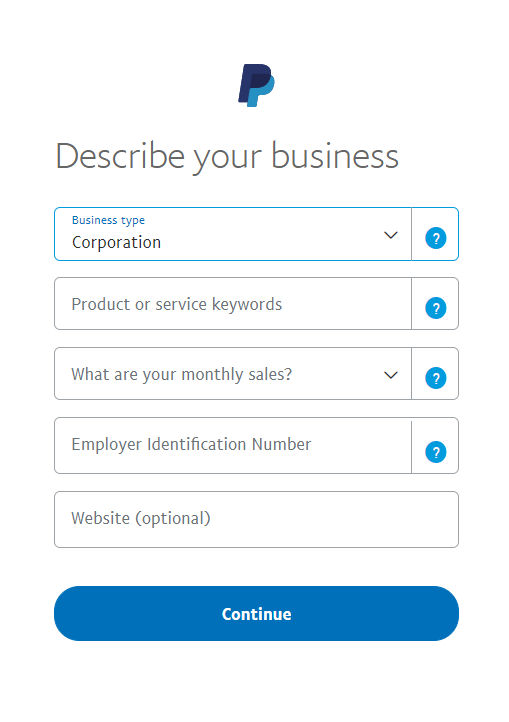

Yous'll demand to provide a business proper name that will appear on customer invoices. And you'll be asked to describe the type of concern you take by selecting from a dropdown list:

- Individual/sole proprietorship

- Partnership

- Corporation

- Nonprofit arrangement

- Government entity

Depending on your concern type, you may be asked for additional information, such as product or service keywords, monthly sales, website, and employer identification number. Still, there are no wrong answers; you simply need to provide the information.

Finally, you'll need to provide customer service contact information, which for a sole proprietor is likely to be y'all.

The costs of a personal and a standard, or start-level, business account are identical. Neither has startup or monthly fees, and both have identical transaction fees.

Just so you know

Create a payment, order, or donation form that works with your PayPal business account, Sign upward for your free Jotform account to get started.

Frequently asked questions about PayPal business organization accounts

-

Do you take to be a U.S. citizen to open a PayPal business business relationship?

-

Is there a minimum income required to open a PayPal business account?

In accord with the 2010 Foreign Account Revenue enhancement Compliance Act (FATCA), users opening a business account may demand to provide tax documents and other verifying information to bear witness that they are a U.Southward. denizen or a non-U.S. citizen who is properly paying taxes on any monies nerveless or earned in the United states or from U.S. citizens.

In improver, to comply with FATCA, PayPal reviews personal accounts oftentimes, and when discrepancies are establish, volition request documentation of citizenry or lawful U.Southward. taxpayer status from account holders.

In that location is no minimum income or sales book required to open up a business concern account. However, to exist eligible for PayPal Working Capital letter, you need to take a concern account upwards and running for ninety days and process at to the lowest degree $xv,000 in a 12-month period.

PayPal business account fees

If y'all desire to offset using PayPal for your business, it's important to understand the PayPal business account fees associated with standard transactions and accepted payments online and in store.

Near of import, there are no initial costs to get started or monthly costs attached to a standard PayPal business account. There are no termination fees either. Using a standard PayPal business business relationship is all-time for businesses that want to salvage on fees and enjoy some flexibility.

If you lot desire to offer a more robust customized and integrated shopping cart and checkout feel for your customers online, you may want to consider upgrading to a PayPal Payments Pro account. It costs $thirty per month, along with the standard transaction fees.

PayPal business concern account transaction fees are only applied when you sell products or services and take payments online or in store. Your business organization pays a standard transaction fee based on the percentage of the total transaction corporeality and the stock-still fee of the currency for the respective country. Below is a breakdown of the percentages and stock-still fees for online and in-shop transactions in the U.South.

| Transaction types | Pct of total transaction amount | Fixed fee amount |

| Online | 2.9% | $0.30 USD |

| In-store | 2.vii% | no fee |

If you lot're selling online or in shop internationally, the percentage of the standard transaction corporeality increases slightly, and the fixed fee amount based on the local currency still applies to your total fees. Here'south a breakdown of the transaction percentages and stock-still fees you might await if doing business in Mexico:

| Transaction types | Percentage of full transaction amount | Stock-still fee amount |

| Online* | 4.4% | 4.00 Mexican Peso |

| In-store | 4.2% | no fee |

*International sales fabricated online incur an additional 3-percent currency conversion accuse and a 1.5 pct charge for receiving a payment from a dissimilar country.

Your PayPal business account fees will vary according to the country you're selling to and accepting payments from. This list of the countries and their currencies volition help you lot calculate the fixed fee amount for your full transaction fees when selling products/services and accepting payments abroad.

Acceptable forms of payment include Venmo, PayPal Credit, PayPal payments, and all major credit and debit cards with PayPal Checkout and PayPal Payments Standard.

Just and then you know

Looking to accept PayPal payments for your business without additional transaction fees? Get started with our free Form Builder!

Reduced transaction fees for nonprofit organizations and charities

If you're a nonprofit organisation with 501(c)(3) status, you'll pay reduced fees for credit carte du jour, debit carte, or PayPal donation payments in the U.S. and internationally. Hither are the transaction fees and stock-still fees for a nonprofit organisation:

| Location | Percentage of total transaction amount | Stock-still fee amount |

| U.Due south. | ii.two% | $0.thirty USD |

| Internationally | three.7% | varies by country |

To qualify your PayPal business account for discounted transaction fees, yous must verify your nonprofit organization'southward charity status past providing your employer identification number (EIN) and proof of the nonprofit banking concern account linked to the PayPal account via bank statement or a voided check.

Other PayPal business concern account fees

Apart from the standard transaction fees attached to a PayPal business organization account, there are several add-on features that may or may not cost you. Hither are some possibilities:

| Service type | Location | Pct of total transaction corporeality | Stock-still fee amount |

| Online invoice cosmos (doesn't include fees associated with paying the invoice) | U.S. or International | No fee | no fee |

| Micropayments* | U.South. | v.0% | $0.05 USD |

| Micropayments | International | 6.5% | varies by country** |

| PayPal Payments Pro ($30 USD monthly fee) | U.Southward. | 2.9%, plus 3.5% per transaction if using an American Express card | $0.xxx USD |

| PayPal Payments Pro ($30 USD monthly fee) | International | 4.4% per transaction, plus 3.5% per transaction if using an American Express card | varies by land*** |

| Virtual Terminal ($30 USD monthly fee) | U.S. | 3.1% per transaction, plus iii.five% per transaction if using an American Express card | $0.30 USD |

| Virtual Terminal ($30 USD monthly fee) | International | four.6% per transaction, plus 3.5% per transaction if using an American Limited bill of fare | varies past country*** |

| Mobile Menu Reader | Swipe and cheque-ins in the U.Southward. | 2.7% per transaction | no fee |

| Mobile Card Reader | Key or browse in the U.S. | 3.5% + $0.15 per transaction | no fee |

| Mobile Card Reader | Swiped non-U.Due south. cards | 2.vii% per swipe | one.5% cross-border fee and/or 2.v% currency conversion fee |

*Micropayments are transactions less than $10.

**Click here for micropayment fixed fee amounts by country.

***Click here for PayPal Payments Pro and Virtual Terminal fixed fee amounts by state.

PayPal bank account transfer fees and options

Transferring coin to your bank business relationship is easy as long equally you have a U.Due south. PayPal account already prepare up and linked to your bank business relationship. This transfer tin can be done through a personal or business concern PayPal account, and at that place are two options to consider:

- A standard transfer

- An instant transfer

Cypher-toll Standard Transfers

If you lot've linked a bank account to your PayPal concern or personal business relationship, then you don't have to pay a transfer fee. Transfers typically take one to three business days to be deposited. If you opt to consummate a transfer on a weekend or holiday, information technology may accept slightly longer for the coin to testify upwardly in your account.

Costs for Instant Transfers

With Instant Transfers, yous can transfer money from your business or personal business relationship to your depository financial institution account or debit card in a thing of minutes. Keep in heed that transfers tin accept up to thirty minutes depending on your bank, and yous practice have to pay an additional fee for this service. The price to use Instant Transfer is 1 percent of the total amount you transferred, upwardly to a maximum fee of $10.

Eligibility requirements for transfers

Both standard and Instant Transfers require a linked and eligible bank account. Your bank is eligible if information technology'due south function of the Immigration Firm Real Time Payments program. If you're transferring funds to a linked debit carte du jour using Instant Transfer, your debit carte du jour must be a Visa or Mastercard to be eligible.

You can transfer to whichever linked business relationship (depository financial institution or debit carte) that you lot choose. Go on in heed that there could be a delay in your transfer if it's subject to review, submitted after 7 p.m. Eastern fourth dimension, and on weekends or holidays.

PayPal business account vs personal business relationship withdrawal limits

If your business chooses to use Instant Transfer for your PayPal business organization account, there are withdrawal limits based on business relationship type. Check out the withdrawal limits below:

| Withdrawal limit type | Withdrawal limit corporeality | Business account or bank |

| Past transaction | $50,000 | business account |

| Past transaction | $25,000 | banking company |

| Past 24-hour interval | $100,000 | business concern business relationship |

| Past week | $250,000 | business account |

| Past month | $500,000 | business business relationship |

If yous desire to use Instant Transfer for your PayPal personal business relationship, below are the withdrawal limits on your debit menu and bank:

| Withdrawal limit type | Withdrawal limit amount | Personal debit menu or banking concern |

| By transaction | $5,000 | debit carte du jour |

| By transaction | $25,000 | bank |

| By day | $5,000 | debit card |

| Past week | $5,000 | debit carte |

| By calendar month | $15,000 | debit carte du jour |

PayPal business account fees vs personal account fees

Opening a PayPal business account or personal account is complimentary, unless y'all choose to upgrade your business relationship. There are no startup costs, termination fees, or monthly maintenance fees for the standard version of these accounts.

The master difference betwixt the two are the transaction fees. A business organisation account will incur charges based on standard transaction fees and fixed fees from selling products or services online or in-store.

A personal account, on the other hand, charges transaction and fixed fees in the U.S. and internationally when you receive coin from someone who uses a credit menu, debit card or PayPay Credit. A personal business relationship won't charge fees if you receive money from someone using a linked depository financial institution business relationship, PayPal Greenbacks, or a residue from PayPal Greenbacks Plus.

| Payment method | Location | Fees | Fixed fee amount |

| PayPal Cash or PayPal Cash Plus | U.S. | waived | none |

| Credit menu, debit menu, or PayPal Credit | U.S. | 2.ix% of the full amount | $0.30 USD |

| PayPal residual or linked depository financial institution business relationship | International | five% of the amount sent, from $0.99–$four.99 USD | none |

| Credit carte, debit menu, or PayPal Credit | International | v% of the amount sent, from $0.99–$four.99 USD, plus 2.nine% of the transaction amount from a specific payment method | varies by country |

Also, transferring your money to your bank from a business account or a personal account is typically gratis, unless you use Instant Transfer. In this case, the withdrawal limits differ depending on whether you take a business account or a personal business relationship.

The cost to buy in the U.South., however, is e'er free for either account type.

Frequently asked questions most PayPal concern business relationship fees

-

How much does information technology price to first using my PayPal business business relationship?

-

What are the minimum fees I should look to pay for my PayPal business account?

-

When doing business internationally, are there currency conversion costs involved?

-

How much does it price to transfer coin from my PayPal business organization account or personal account to my bank or debit card?

It's completely gratuitous to become started. There are no startup costs, monthly fees, or termination fees.

You should expect to pay the standard transaction fees for online and in-store transactions in the U.S. and internationally, and any fixed fees for the corresponding country.

Find out more than from the breakdown of costs above.

Yeah. Y'all will be charged an additional 3 per centum for currency conversions and a 1.v per centum fee if you receive payments from a different country.

For a standard transfer, there are no costs. For Instant Transfers, which tin requite you lot admission to your funds in equally fiddling as 30 minutes, the cost is 1 percentage of the total amount you transferred, upward to a maximum fee of $10. Continue in heed that there are withdrawal limits for your business account and personal account if you're using Instant Transfer.

How to set a PayPal business account

Ready to first accepting payments for your business with a PayPal business organization account? You tin can get up and running in simply a few piece of cake steps. Hither is a step-by-step guide to help.

Setting upwards a PayPal business account

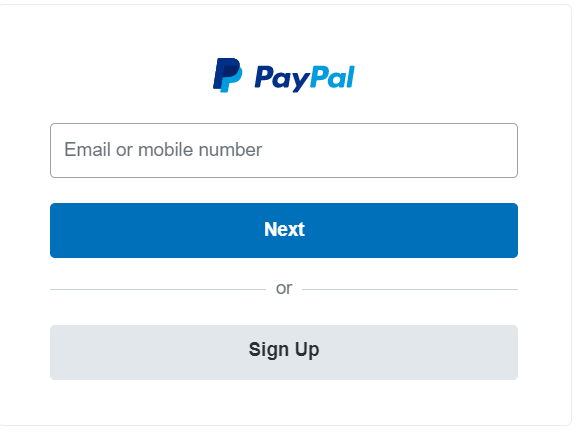

- First, make sure you have an email set up with PayPal. If not, click Sign Upwards to get started. Call up, signing up for a PayPal personal or PayPal business organization account is gratis.

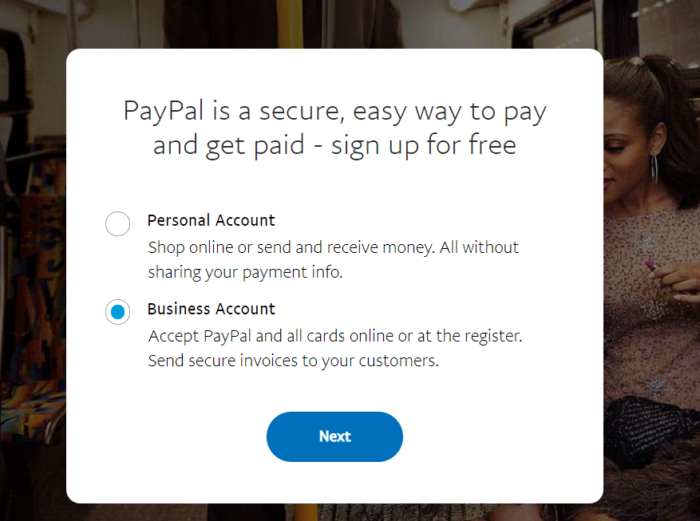

- Next, you'll be asked what type of account y'all want to set up. Select Business Business relationship and click Adjacent.

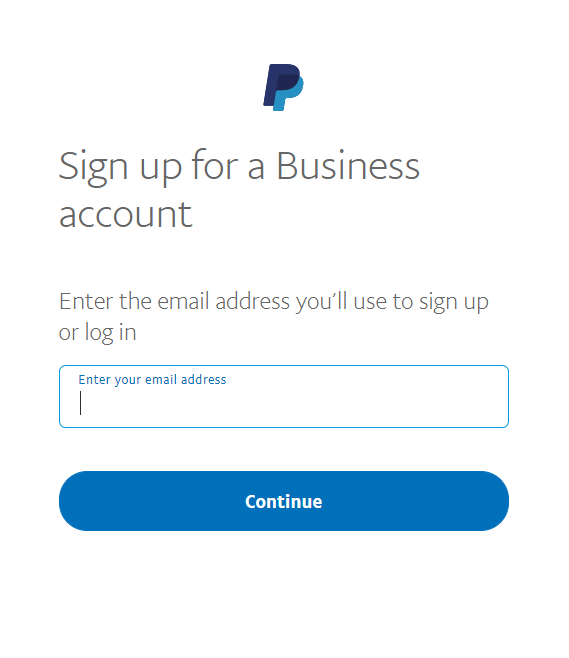

- On the next screen, you'll exist asked to enter the email address you want to use to fix upwardly your PayPal business organization account. Enter the email you want to utilize, and then click Keep.

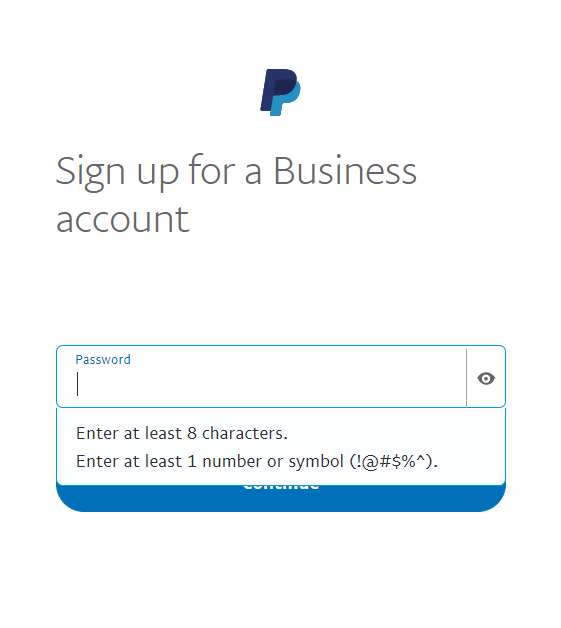

- After you enter the email address, create a password. Your countersign must be at to the lowest degree eight characters and contain at least one number and symbol.

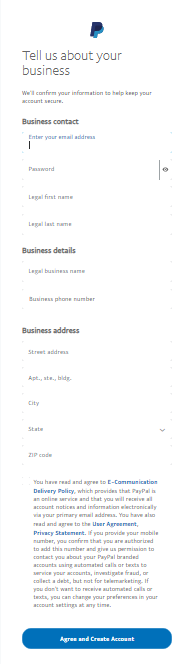

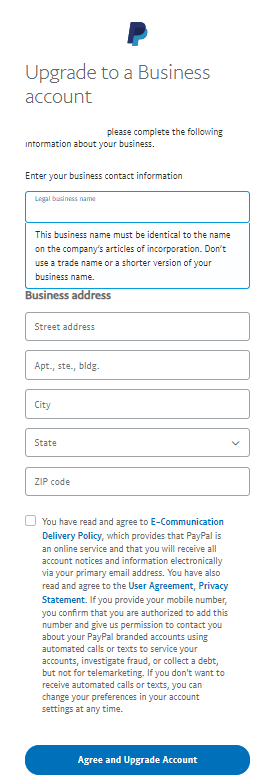

- Later on you ready a password that meets the requirements, you'll be taken to a screen that says, Tell usa about your concern. Here, you lot'll provide more than information about your business, such equally the business contact'due south proper name, the business proper name, and the business concern address.

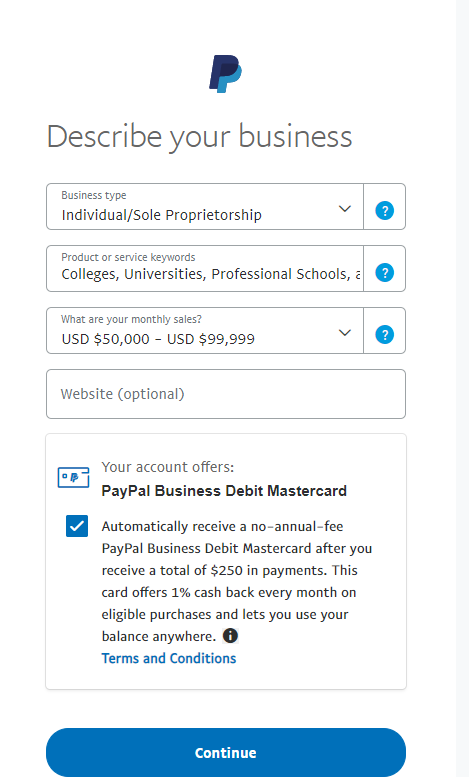

- On the next screen, you'll be asked to describe what type of business y'all have. You tin select from a dropdown list. Depending on the business organisation type, you lot may exist asked for additional data, such as product or service keywords, monthly sales, website, and employer identification number.

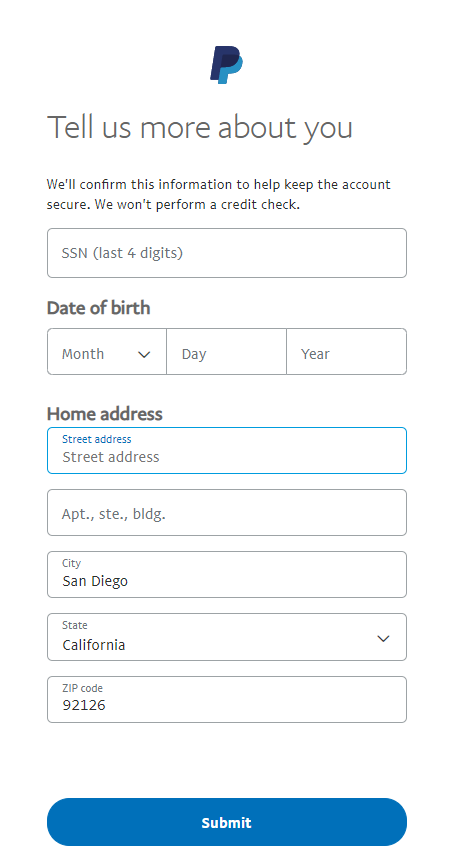

- Side by side, you'll be asked to provide some personal data to set upwards your account, including the final four digits of your social security number, your birth date, and your home accost. PayPal won't perform a credit cheque based on this information. After you've added all of your personal information, click Submit.

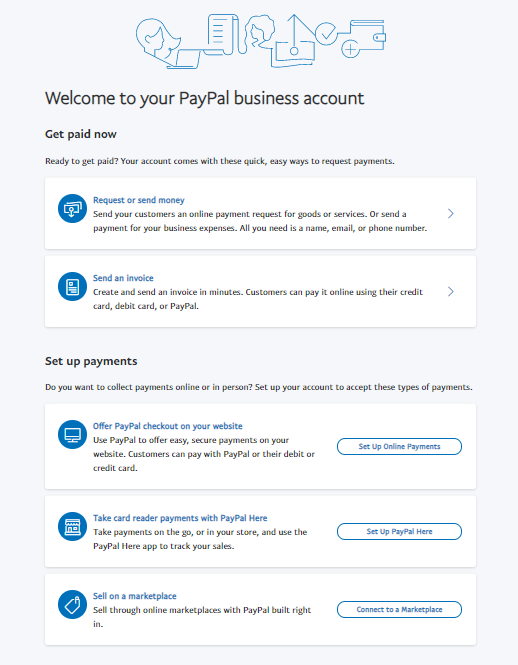

- Once you've submitted your data, your PayPal business concern account is set up and ready to utilise. You lot'll be taken to a page to select from a range of features you can use for your account.

Just so y'all know

Did you know you tin use Jotform to collect PayPal payments for your concern? Create your online payment grade for free today!

You lot'll also be asked to agree to an E-advice Delivery Policy, a User Agreement, and a Privacy Statement. In one case you've read through these documents and are ready to continue, bank check the box and click Agree and Create Account.

Based on the information you give, you may exist asked if y'all want to receive a PayPal Business Debit Mastercard, which allows you to quickly and easily access coin in your PayPal account much in the same way you would access coin from a typical bank account.

This bill of fare has no annual fee one time you've received at least $250 in payments. You tin use the card residue anywhere that has the Mastercard logo and get i percent cash back each month on select purchases.

Click on the box if you would similar to receive this account offer, or unclick it if you don't desire information technology, then click Go along.

For example, you tin request or send money, ship an invoice, gear up recurring payments for your business, or take reward of services like PayPal Checkout to accept payments online. You can too fix up your account to accept card reader payments if you're mobile, in store, or using the PayPal Hither sales tracker app.

Finally, you lot tin can connect to an online marketplace with PayPal already built in to accept payments that fashion.

How to upgrade or downgrade a PayPal business business relationship

Upgrading to a PayPal business account is beneficial for e-commerce businesses that want to customize and heighten the shopping and checkout experiences for their customers. Yous tin can upgrade your personal business relationship to a business account in but three easy steps. All the same, it can take a bit longer to downgrade your business account to a personal business relationship considering this has to be done manually.

Just then you know

Collect online payments for your concern directly through your forms with Jotform'south PayPal Commerce Platform integration.

Upgrading to a PayPal concern account

If you lot adopt, you can have multiple PayPal accounts: a personal and a business concern business relationship, but y'all have to utilize unique emails for each business relationship.

If yous'd like to utilize your PayPal personal account e-mail to upgrade to a PayPal business account, follow these steps:

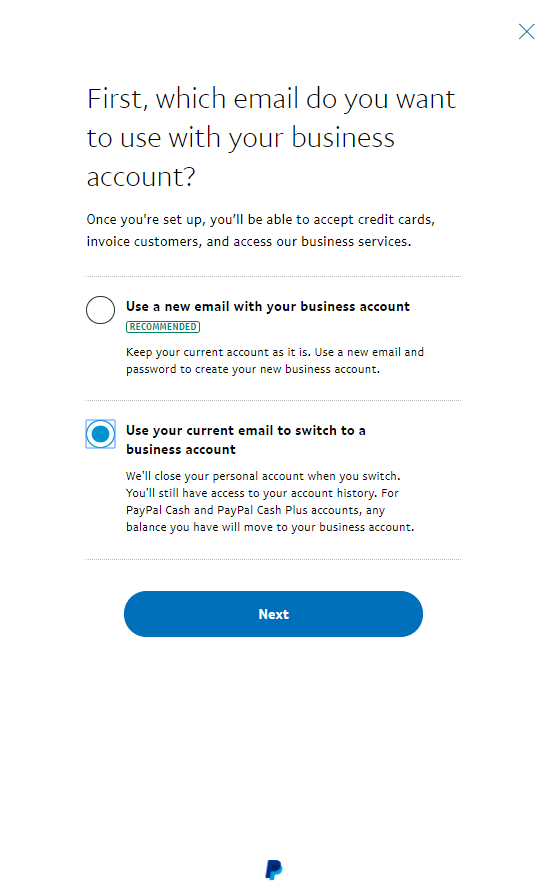

- On the login folio, select Sign Upwardly, choose the Business Account option, and then click Next. Afterward you complete your personal business relationship login data, you lot'll be asked if you want to switch your current personal business relationship to a business account. Select Apply your current e-mail to switch to a business account, and so click Adjacent.

- On the next page, you'll be asked to fill out your business data and and so agree to the terms and conditions.

- One time y'all've done this, you'll go through the same steps every bit in the How to prepare up a PayPal Business account section.

Upgrade PayPal business account options

There are two primary PayPal business accounts to choose from. One is free, and one charges a monthly fee.

Standard

This business relationship is free, accepts all major credit card and debit card payments, accepts PayPal payments, and allows customers to pay over time if they choose. In that location is no monthly fee.

Payments Pro

This account has a monthly fee of $thirty. PayPal Payments Pro includes all the features of a standard account merely allows you to customize your customer's checkout experience and to integrate with your established shopping cart.

Downgrading a PayPal business business relationship

If you'd like to catechumen your PayPal business concern account to a personal account, yous'll demand to contact a PayPal customer service representative directly. Changing your PayPal business organization account to a personal account can just be done manually.

How to delete and close a PayPal business organization business relationship

At that place are plenty of reasons you might delete and close your PayPal business business relationship. For case, if

- Your business relationship has been compromised and must be close down to protect your data

- You're no longer in business organisation and don't plan to use the account anymore

- You want to create a new account with a unlike email address

- You want to use a different business account

Whatever the reason, you lot tin delete and close your account in just a few piece of cake steps.

- The outset step is logging into your account and transferring any remaining balances from your PayPal business account to your bank. If you request a check, you lot'll exist charged a processing fee of $1.50.

- Next, download any data y'all want to keep. For example, you may want to download your transaction history from the Activity tab or your financial statements and summaries from the Reports tab. Once yous delete and close your business relationship, you lot won't be able to admission this information anymore. Make sure to download anything y'all don't want to lose.

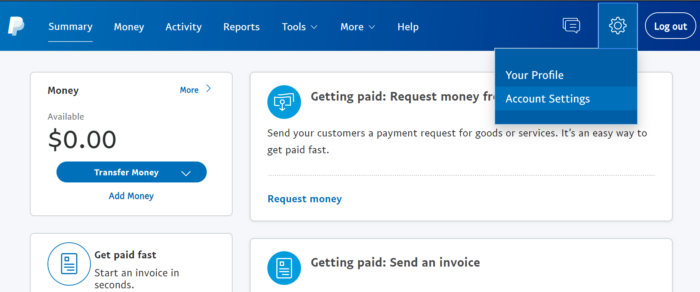

- Once you've transferred any remaining funds to your depository financial institution and downloaded the data you lot want to keep, click on the gear icon on the far right-hand corner and choose Business relationship Settings from the dropdown menu.

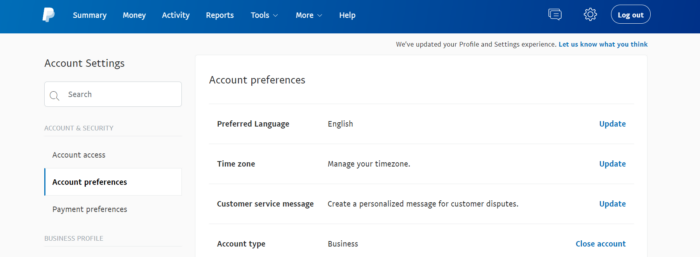

- On the Account Settings page, there will be three options under the Account & Security menu on the left-hand corner. Click on Account preferences.

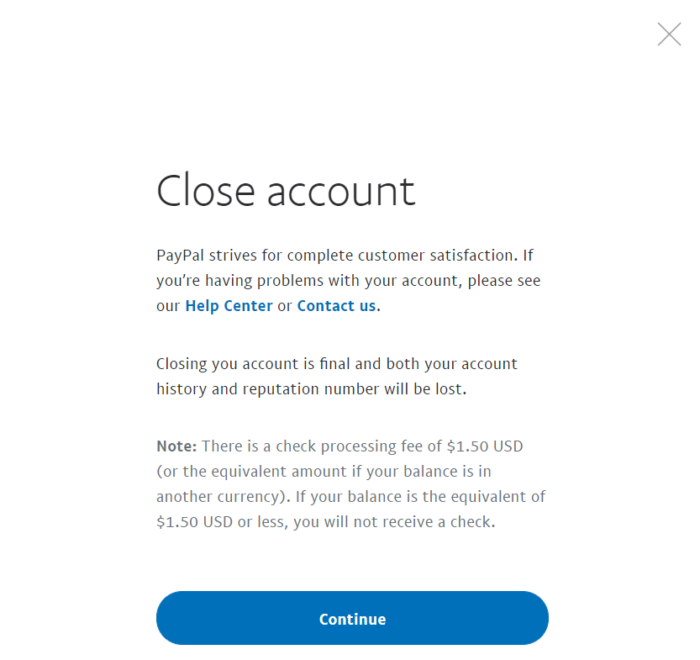

- At the bottom, where it says Business relationship type, click the Close business relationship link. Once you click on this link, you'll be redirected to a page that informs y'all that closing your account is terminal and that all your history will be lost. If you lot hold to these terms, click Continue.

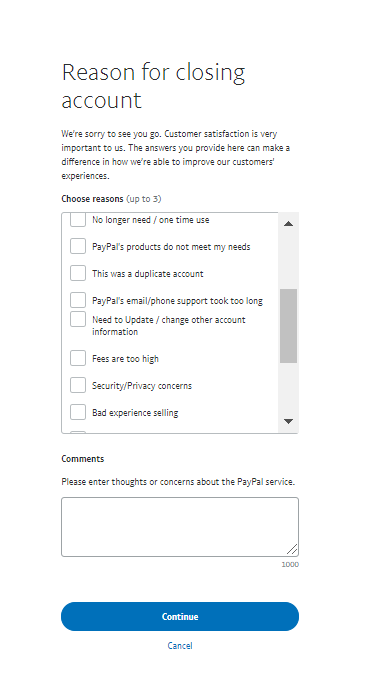

- Finally, you lot'll exist asked to provide up to three reasons why yous're closing your account. Once you've made your selections and added whatsoever comments, click Continue.

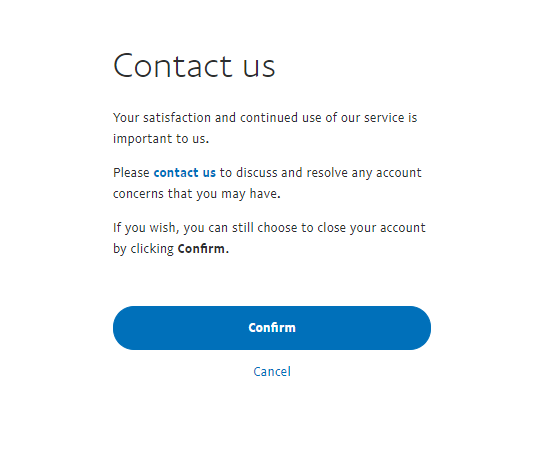

- PayPal will ask you to confirm that you're endmost your business account one concluding time. If you're certain this is what you want to practise, click Confirm, and your business account will officially be deleted and closed. You'll no longer exist able to admission it.

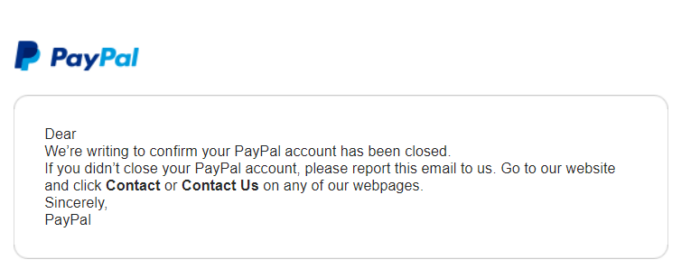

- Within the adjacent 24 hours, you lot should receive a confirmation email from PayPal that says your account has been permanently deleted and closed.

How to apply Jotform to sell products and collect payments

Now you have all the facts, and mayhap you've settled on a PayPal business organization account as your PSP. Maybe you've fix up your account, and you're ready to kickoff watching your bottom line grow.

Alternatively, you may yet be deliberating or comparing options. Regardless of where you lot are in the decision-making procedure, it'due south important to remember that having the power to collect payments is only ane small-scale slice of the puzzle.

Just so you know

No thing what products or services you sell, get paid online with Jotform's PayPal Commerce forms.

Some other critical chemical element is creating the infrastructure that will allow you to effectively market and sell your products and subscriptions, or collect donations and raise money online. This may feel especially intimidating if y'all're not particularly web savvy.

Similarly, if you're a microbusiness with limited resources or a nonprofit that's e'er contesting confronting time, yous may non take much time to spare setting upwards an eastward-commerce site or learning the ins and outs of website development and design.

The skillful news is that Jotform offers a form edifice solution that makes it every bit easy to sell products equally PayPal makes information technology to collect payments. The even better news is that you can create a PayPal payment class with Jotform, and then information technology'due south incredibly simple to get your goods in the hands of your customers and get paid!

This option is peculiarly useful for charities and organizations accepting donations, anyone putting on events, order-based businesses, DIY entrepreneurs, and fifty-fifty professional services providers. Truth exist told, whatever business organization — big or small — can employ Jotform's easy online Course Builder to create lodge forms, recurring subscription forms, membership forms, and more in merely a couple of clicks.

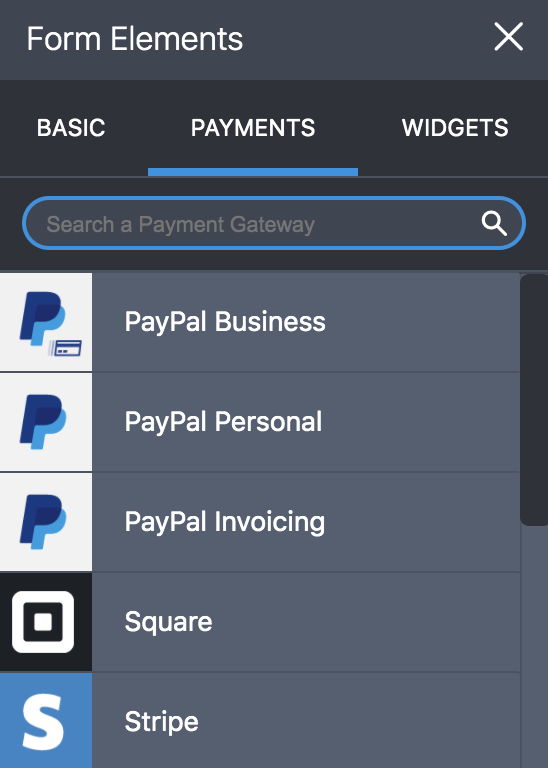

So it's merely a matter of selecting either the appropriate PayPal Personal, PayPal Business, or PayPal Invoicing option from the Form Elements section in the Jotform Form Architect and completing the steps that follow.

Jotform not but makes information technology a snap to start selling your goods and services, but the uber popular class builder also doesn't charge whatsoever extra transaction fees. PayPal'southward standard fees apply as normal. The only fees y'all pay Jotform are for your account, unless you're on a free program.

And if that's not enough to pique your interest, here are a few other great reasons to consider using a JotForm-PayPal business account integration to start selling and collecting payments:

- It'due south flexible. Jotform gives y'all the ability to collect everything from payments for products with a specific price to recurring subscriptions to custom donation amounts.

- Information technology comes at no toll. Not simply does Jotform forego charging any additional transaction fees, the platform also offers a free account choice that gives users the opportunity to have 10 payments per month on the house. If you programme on accepting more than, you tin can opt for any of the other Jotform plans.

- Information technology's as easy as 1-2-3. Anyone and everyone can use Jotform's drag-and-drop Course Builder to put together well-nigh any kind of form. It'south beyond uncomplicated.

- No technical expertise needed. No code know-how required. Yous don't need evolution cognition to use Jotform, and thank you to the platform's super robust Assistance section, even if you lot exercise run into a problem, there are resources and support bachelor to give you the guidance you need.

- Thousands of templates. Among their 10,000 form templates, Jotform has templates made just for PayPal.

- End-to-end customization. From adding your own branding to uploading an image to make your form look friendlier, Jotform's Form Builder makes it a breeze to customize templates. And if you practice have some engineering skills, you can even add CSS to create the kind of forms your customers or donors will love.

- PCI compliance. When the take a chance of cyberattacks and fraud seem to exist increasing daily, customers want to know your website is secure. Jotform provides both your business organization and the people supporting it with the highest level of security protection.

In fact, it's the merely form provider that's Payment Credit Industry Data Security Standard (PCI DSS) Service Provider Level I certified, the highest security attainment you can have as a concern that collects payments from and integrates with credit cards. Information technology'due south also GDPR compliant, CCPA compliant, and it allows for form encryption.

This article is originally published on February 25, 2020, and updated on Mar 10, 2022.

RECOMMENDED ARTICLES

griffithcidew1966.blogspot.com

Source: https://www.jotform.com/paypal-business-account-guide/

0 Response to "Paypal Limits When Having to Upload Business Docs"

Postar um comentário